Ideas for a Bear Market

As I outlined last week, I’m not too confident in equities for 2007. If you're on the same side of the fence, it may be time to reduce your equity exposure. Here are some investments that should perform well in a bear market:

As I outlined last week, I’m not too confident in equities for 2007. If you're on the same side of the fence, it may be time to reduce your equity exposure. Here are some investments that should perform well in a bear market:Bond Funds

Stick more of your money in bonds. If the futures trading activity is any indication, there is a much higher probability of a Fed cut this year than a rate hike. When interest rates are going down, the prices of bonds rise.

My recommendation would be First Trust’s Strategic High Income Fund (NYSE: FHI). FHI is a high-yield bond fund with an astounding 9.2% dividend yield! If rates do indeed fall, you will gain both appreciation and dividends. If it stays flat, you’ll still realize a 9.2% gain while the stock market struggles. And because it’s an ETF, you have several advantages over traditional mutual funds: you can buy & sell like a stock, fund expenses are much lower, dividends are paid monthly, there are no redemption fees for investing less than 1 year, and you are not dealing with a 3rd party.

Short Funds

If you are 100% convinced that the stock market will crash in 2007, check out ProShares family of Short Funds (some call them the “Un-American” funds). These ETFs are designed to move in opposition to the major indices such as the Dow, Nasdaq, S&P500 & MidCap400.

For example, if the Dow Index falls 10% in 2007, the Short Dow30 Fund (NYSE:DOG) will gain 10%. Even more confident of a down market? ProShares also offers “Ultra” Short funds that move 2x in the opposite direction. For example, if the Dow falls 10%, your UltraShort Dow30 Fund (NYSE:DXD) will gain 20%! As you may have guessed, these funds struggled during 2006’s bull market losing 13% and 26%, respectively.

Be aware that the UltraShort Funds are VERY risky and should not be markup a large percentage of your portfolio unless you are either Nostradamus or executing a short-term trade. For example, if the US invades Iran or there is another domestic terrorist attack, the UltraShort funds could protect your holdings while the predictable selloff occurs.

A more conservative play is the Prudent Bear Fund (BEARX) which invests in a variety of securities that perform well in down markets: short sales, futures, CDs, value stocks. I’ve held this mutual fund for roughly 6 months, and despite the huge run in the stock market, it’s held up pretty well. Plus it pays a nice dividend. This is by far the most widely-held bear fund & is actively managed, unlike most ETFs.

Energy and Defense

Energy and Defense-related stocks generally perform well in bear markets. Energy stocks have been struggling the last several months as the price of oil has fallen over 35% from its peak of $78.40 last summer. There were 3 key reasons for this fall:

· Unusually warm winter weather

· Absence of geopolitical risks

· Concern whether OPEC can control rising inventories

But oil appears to have reached a bottom as it was met with huge resistance at the key $50 level this week. Bullish sentiment from veteran investor T. Boone Pickens helped oil when he was quoted in The Wall Street Journal as predicting an average price of $70 a barrel in 2007. I would recommend the US Oil Fund ETF (NYSE:USO) that follows the price of crude without having to deal with futures contracts. Otherwise, the Oil Service Holders ETF (NYSE:OIH) is a more diversified basket of energy stocks that should perform well in a bear market & as oil recovers.

Also take a look at alternative energies. At Tuesday's State of the Union Address, President Bush is set to unveil his strategy to confront global climate change and work toward energy independence. PowerShares WilderHill Clean Energy Fund (AMEX:PBW) is an ETF that includes solar power, ethanol, wind & carbon energy stocks. With Bush finally admitting our "oil addiction" and the Democrats getting serious about global warming, these stocks should see increased exposure & possibly government funding.

Defense stocks have also been struggling as geopolitical conflict has been relatively quiet (with the exception of Iraq). Any conflicts with Iran, North Korea, Afghanistan, Venezuela or Syria (just to name a few) would aid defense-related spending. Also keep in mind President Bush is approaching his final year in office. Remember what his father did during the last few months of his Presidency?

Democrat-Related Stocks

One warning with Energy & Defense-related stocks: these normally do not perform as well when Democrats hold office. With the Democrats holding majorities in both the House & Senate, more focus could go to alternative energy, stem cell & biotech companies. But this may not happen until Bush leaves office and loses veto power. If a Democrat wins the Presidency next year, avoid health care, defense, pharmaceutical & oil companies.

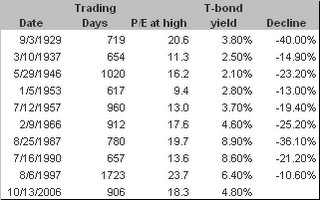

The last few months, the spread between the 3-month & 10-year bonds has been -0.40% indicating a ~40% chance of a recession.

The last few months, the spread between the 3-month & 10-year bonds has been -0.40% indicating a ~40% chance of a recession. This rally cannot ignore all these deteriorating economic conditions forever! If you think the stock market will keep plugging along, you’re certainly not alone. But several of the current bearish economic indicators must disappear for this to happen.

This rally cannot ignore all these deteriorating economic conditions forever! If you think the stock market will keep plugging along, you’re certainly not alone. But several of the current bearish economic indicators must disappear for this to happen.